Understanding the ins and outs of insurance in Vietnam is very difficult, especially because the written rule is very rarely followed. You may well think you are insured but because of some misunderstanding or slight error you end up not being covered. Add to this that the implementation of these rules by cops and insurance companies is vastly different. Here we try to break down the confusion and give you a simple guide to what you need to do and how to do it.

Read on to find out how to get 3rd party and/or Theft and Damage Insurance for your motorbike or a rental as a long term resident of Vietnam.

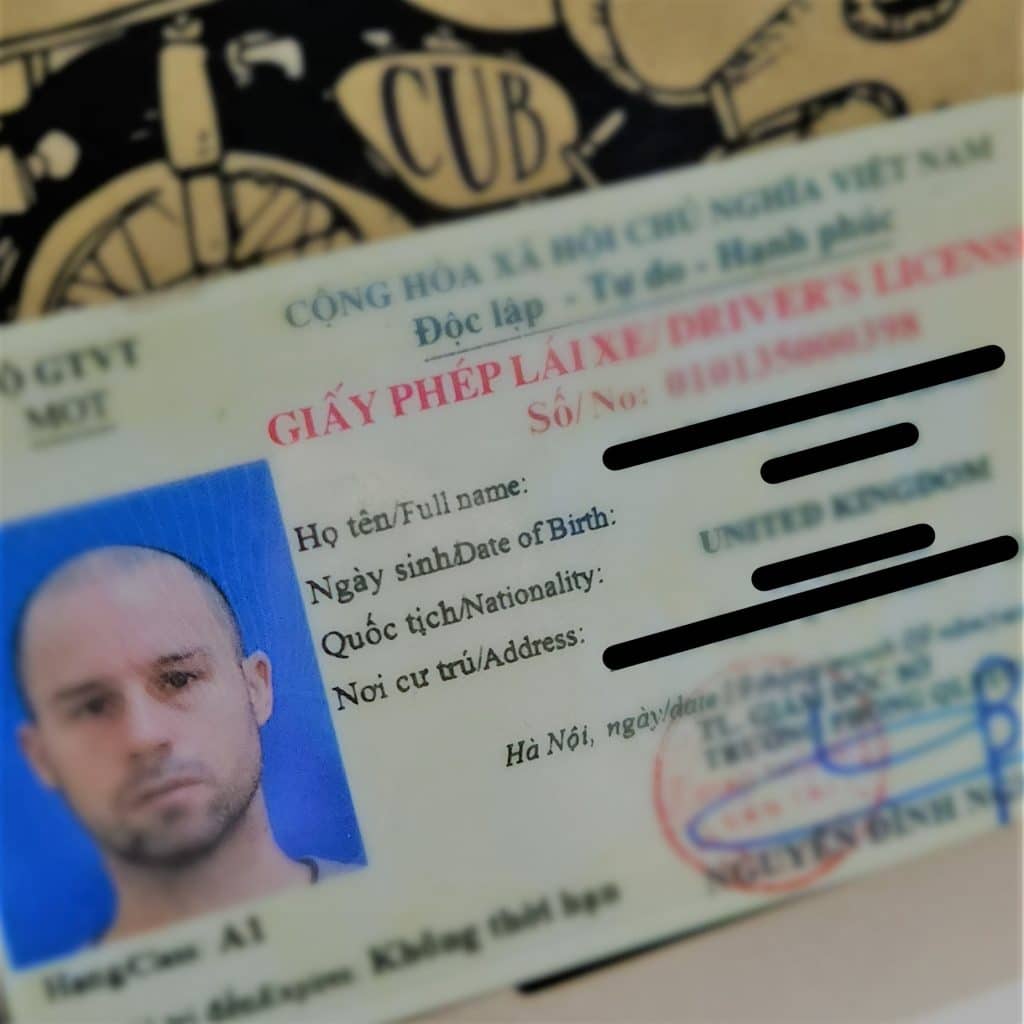

You Need a Vietnamese License

First of all, for any of your insurance to be valid you need to be driving legally and have a license. You can find out how to drive legally in Vietnam here. As with any insurance policy, you will not be covered for any illegal activity. This is pretty much standard and understood. Note that for a 50cc motorbike, no license is required.

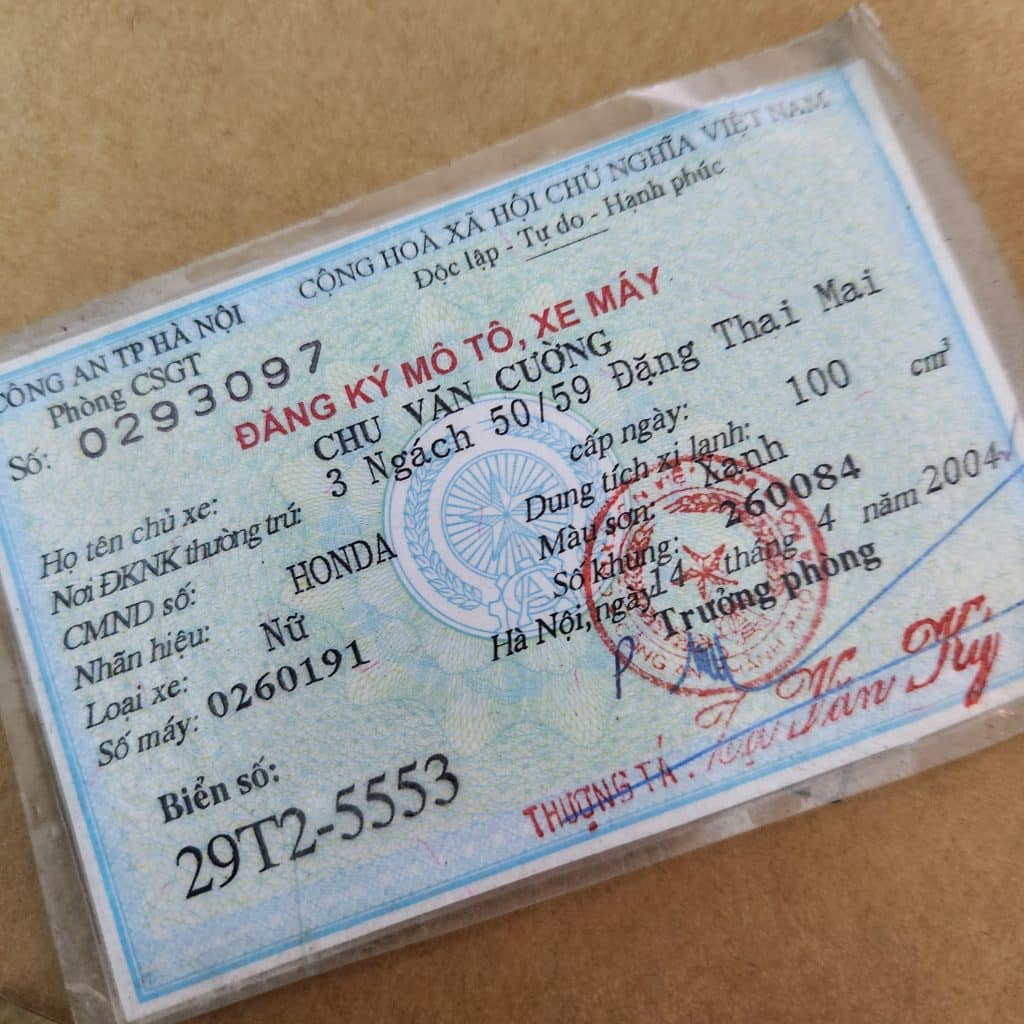

You Need the Blue Card

The Blue Card; what is the Blue Card? Well, this is the vehicle registration document (that used to be blue, but is now orange) that you get when you buy a motor vehicle. It is supposed to show that the vehicle is not stolen.

If you have possession of the Blue Card, you are seen to be the owner of that vehicle even if your name is not on the card. This document will usually have the original owner’s name on it. Many people do not transfer this document to their name, for many reasons, so insurance companies have opted to insure the vehicle and not the person for 3rd party insurance.

It is also why rental companies will only ever give you a copy of this document and not the original with which you could then sell the vehicle.

Rest assured that the insurance is for the vehicle and will still be valid if your name is not on the Blue Card.

NOTE: There is only one issue you may have with the Blue Card and that is it could be fake. Losing the Blue Card is such an issue that people will fake them rather than go to the hassle and expense of replacing it. Or, it may be that a bike is stolen hence a fake is required. Be sure to check, or have someone who knows check, the blue card.

There are Two Types of Motor Vehicle Insurance.

1. Compulsory Motorbike Insurance in Vietnam

This is legally required and you must produce this at any traffic stop. It is just one of the things that you will be asked for. You should note that without this insurance you are driving illegally ( even if you have gone to the effort of getting a driver’s license ). As mentioned above, you may find that your health insurance policy will not pay out because you are driving illegally.

This is a third party insurance and in general covers :

CHECK

- 100 million VND per person per case in relation to people

- 50 million VND per person per case for assets

Buying 3rd party motor insurance in Vietnam is very easy

There are many small agencies that offer this and you can also find insurance for sale at many small mechanic shops and petrol stations. The large insurance companies, such as: BaoViet, Liberty and Infinity are also happy to sell it. We purchase this for around 100,000vnd per bike but you may be able to find it cheaper. Considering that it is required but you will probably never be able to claim on it, you should try not to overpay.

To purchase this, you will need to show the Blue Card of the vehicle and your Vietnamese driving license. Again, how valid a foreign health insurance company will see this, is unknown. However, once you have this you can legitimately claim that you did everything possible to drive legally.

Interestingly, there is a lot of public resistance to this 3rd party insurance as they typically do not pay out and it is seen a a scam. In 2016, only 6% of the premiums paid was returned to the customers as a result of claims. It is still compulsory.

If you are renting a motorbike, you should use the company that has this for its rental bikes. Rentabike Vietnam provides this insurance as standard to anyone who is driving legally. How easy and possible it is to make a claim on this insurance is another thing. However, you will be able to provide this to your health insurance provider to show you did everything you could to drive legally.

2. Motorbike Theft and Damage Insurance in Vietnam

If you have your own vehicle in Vietnam you may wish to buy insurance against accident damage and theft. It is difficult to find a provider for this but it is sometimes possible through BaoViet or Liberty. Rentabike Vietnam provides a Damage Waiver but NOT Theft or Health Insurance.

The policies for this, offered by the large insurance companies, are varied and based on case by case scenarios. You will need to consult with these companies to find out exactly what is required, what they cover and how much this will cost. From experience, the policies are quite reasonable.

All in all, it is not that difficult to get compulsory 3rd party insurance so it is something that you should make sure you do or ask your rental company to do. Driving legally is a little more difficult and is something that you should look into before considering insurance as you will not be covered unless you have a license.

Theft and damage insurance is another level of difficulty and also health insurance that covers driving on a day to day basis / off road / as part of a tour is even more complex.

For more clarification leave a question in the comments or get in touch with us to talk about your specific details.

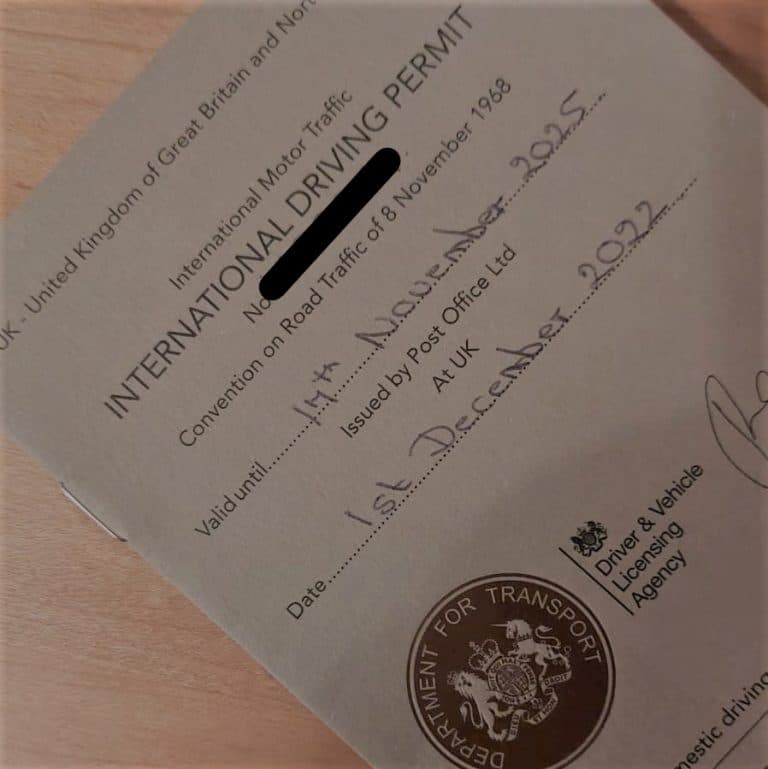

Driving on an IDP and Insurance

If you are a tourist and are driving in a Home License and an IDP, then you will need to contact your insurance company to find out if they will cover you or not.

You will probably need to ensure that the vehicle you are driving has the 3rd party insurance. This is just in case the insurance company ask for this and claim you were driving illegally without it. You know how they will do anything not to pay out.

There shouldn’t be any issue as the insurance is for the vehicle and not the rider. Therefore, so long as the 3rd party insurance is paid up and valid and you have all your necessary documents, you should be totally legal.

Some companies will cover you and some will not. It is best to get written confirmation from the insurance provider, just in case the worst happens.

So, as you can see, there are many twists and turns and you could easily fall foul of all of this legislation. Hopefully, you now have a clearer idea of what is needed and how to go about getting it. If there is still some confusion or argument, get in touch through the comment box and we will do our best to help.